is hoa tax deductible in california

You would then add this to the cost basis of your home which will decrease your profit in turn it will also. If youre claiming that 10 of your home is being used.

Minimize Property Taxes Ca Prop 60 90

Tip If you have a vacation home that you use for a.

. HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff. Whether the HOA fee is tax-deductible or not depends on how you utilize the property. Homeowners donating to the HOA cannot deduct these on their tax returns.

Are homeowners association fees tax deductible. But there are some exceptions. HOAs as Beneficiaries of Homeowners Homeowners can donate.

This allocation will negatively impact the 90. However if you use the home for some. The IRS considers HOA fees as a rental expense which means you can write them off from your.

Year-round residency in your property means HOA fees are not deductible. However there are special cases as you now know. If the second home is a vacation property where you reside in it some of the time.

However since it is not subject to California corporation income tax it is also not taxable to the tax-exempt homeowners association. Yes and no. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

60 Percent Test Sixty percent. The IRS views them as personal expenses not a tax rendering them ineligible as tax. Generally HOA dues are not tax deductible if you use your property as a home year-round.

However there are exceptional cases as you currently understand. You can also deduct 10 of your hoa fees. Monthly HOA fees are tax-deductible when the HOA home is a rental house.

Filing your taxes can be financially stressful. You would total up the HOA fees but not tax assessments. It is not tax-deductible if the home is your primary residence.

Orange County First-time Homebuyer Grants Available Home Buying The Way Home First Time. In general HOA fees are not tax deductible in California. As a general rule no fees are not tax-deductible.

As a general guideline no expenses associated with homeowners associations are not tax-deductible. It specifies that only the portion of expenditures used in the construction maintenance repair or management will be allowed to be deducted. So yes hoa fees can be deductible if your house is a rental property.

Is HOA tax deductible in California. As far as home office deductions go you are allowed to deduct home expenses equal to the portion of your home office. A Homeowners Association HOA is a governing body that sets specific rules and guidelines that you agree to abide by when you purchase property in a condominium gated.

If you are paying hoa fees its your responsibility to learn what your tax obligations are. Thus HOA donations are not tax-deductible. There may be exceptions.

Are HOA fees tax-deductible. Yes HOA fees are deductible on a home you dont live in that you use as a rental property.

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Hoa Dues Vs Hoa Fees Vs Hoa Assessment Clark Simson Miller

California Hoa Condo Tax Returns Tips To Stay Compliant Template

Can Hoa Fees Be Used As A Tax Deduction For A Second Home

Step By Step Guide To The Hoa Assessment Collections Process Homeowners Protection Bureau Llc

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

The Definitive List Of 35 Home Business Tax Deductions

Hoa Tax Return The Complete Guide In A Few Easy Steps Template

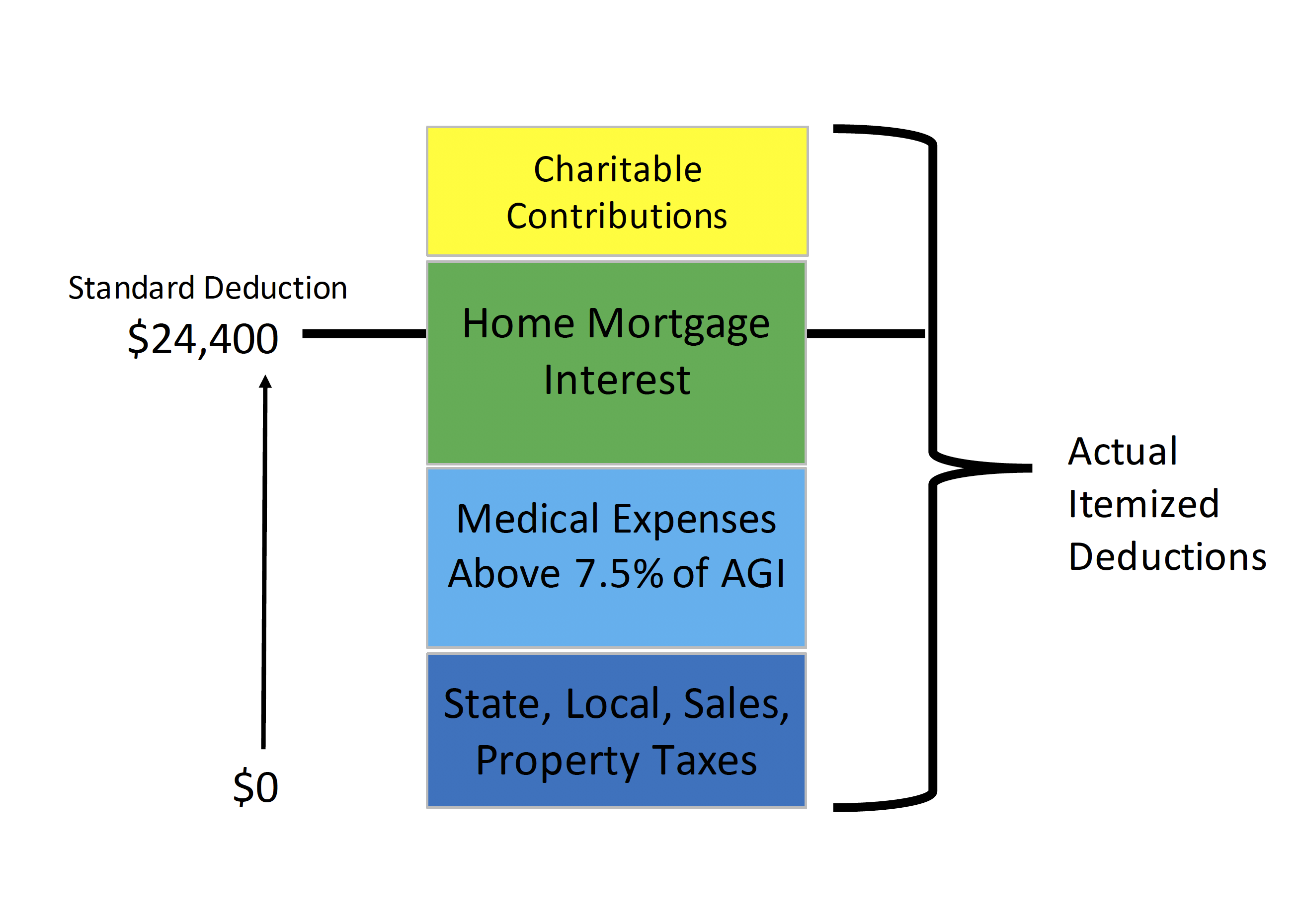

March 2019 Charitable Contributions Are They Still Tax Deductible Marin Financial Advisors

Maximum Mortgage Tax Deduction Benefit Depends On Income

Hoa Fees Things To Keep In Mind When Searching Va Approved Condos

Hoa Tax Returns A Complete Guide

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

What S The Difference Between Hoa Assessments And Hoa Fees Cm

Overwhelming Majority Of California Hoa Residents Are Satisfied

Homeowner Association Hoa Appeal Letter For Proposed Solar System Ca Cleantech Docs

California Hoa Condo Tax Returns Tips To Stay Compliant Template